Our Strategy

The Thinker Approach

Understanding that the project required immediate initiation, our team quickly immersed itself in the intricacies of the insurance landscape. We conducted extensive secondary research on competitors and performed primary user journey analysis to identify critical pain points faced by potential customers.

These essential insights uncovered during our initial analysis laid the groundwork for a digital insurance customer journey focused on a user-centric design strategy that directly addresses core challenges and paves the way for positive customer interactions.

Insights We Drew/ Insights Inferred

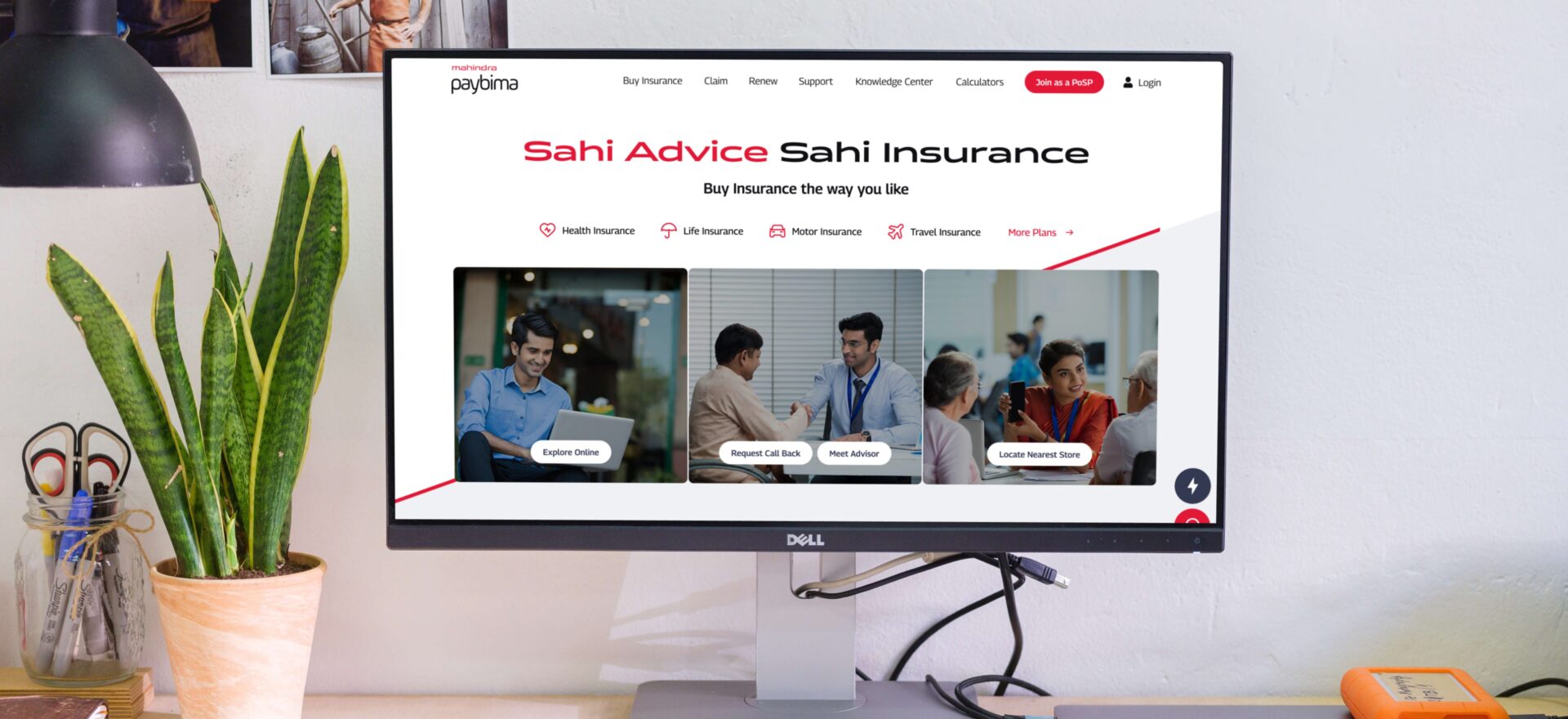

Given that Paybima operates as an embedded system within the insurance market, it was essential to create a platform that not only looks visually appealing but also functions seamlessly. Our design needed to reflect the trustworthiness of Paybima while simplifying complex insurance concepts for users.

Furthermore, we recognized the importance of strategically positioning Paybima as a trusted advisor and companion, leveraging Mahindra’s legacy of offline experience to build credibility in the digital space. This informed our approach to crafting an omnichannel insurance experience design that meets the evolving needs of modern customers.

Key Strategic Interventions

Building Trust through Transparency

We designed features that promote transparency throughout the customer journey, from purchase to claims, ensuring users feel supported at every step.

Education and Empowerment

The platform includes tools that empower users to understand their options better, bridging the knowledge gap prevalent in the insurance sector.

Omnichannel Experience

The design made the omnichannel visible and accessible to the users at important phases in the journey.

Creating Freedom of Choice for Customers

We focused on providing personalized exploration based on customer preferences. The platform allows users to buy insurance in a way that suits them best—whether it’s how they buy, what they buy, or the support they need.

Unbiased Expert Advice & Guidance

Thoughtful nudges based on user inputs guide users toward the best plan tailored to their needs.

KEY FEATURES

01

Unified Management Platform

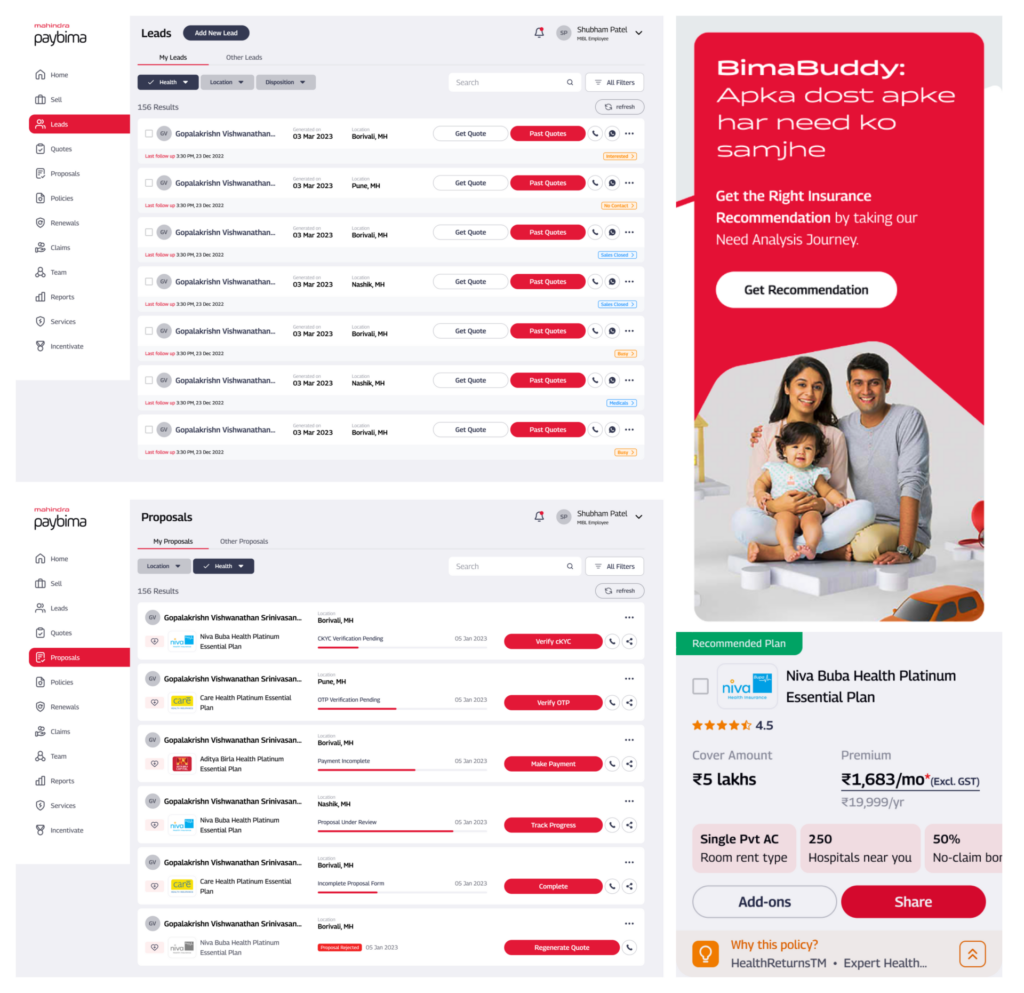

The unified management platform was designed in a way that it provides a streamlined service management portal designed for all PayBima stakeholders (Employees, Sellers, and PoSPs), fostering a centralized approach to customer relationship management from acquisition to ongoing support.

02

Action-Oriented Seller Dashboards

These dashboards enable sellers to efficiently track leads, manage proposals, and monitor performance, fostering seamless communication and improved sales outcomes.

03

Efficient Quote Tracking

Streamlines the quote management process by grouping quotes by date and time, enabling sellers to view and analyze quote performance for better lead conversion.

04

Advanced Lead Tracking

The tool enables sellers to efficiently manage their sales pipeline with features like location-wise views, disposition tags, quick quote generation, and access to past quotes.

05

Seamless Proposal Tracking

Provides upfront visibility of proposal progress, actionable buttons for quick follow-up, and easy lead contact/proposal re-sharing to maximize conversion opportunities.

06

BimaBuddy: Virtual Recommendation Engine

This intelligent engine delivers personalized insurance suggestions by simulating a one-on-one consultation, assessing individual needs, and providing tailored plan recommendations for informed decision-making.

07

Interactive Quote Comparison

Empowers users with a user-friendly interface to compare quotes with ease, featuring detailed policy breakdowns and "Why This Policy?" insights for confident selections.

DESIGN ACTIVITIES

Stakeholder

Workshop

Platform & Information

Architecture

UI Concept Exploration

& Concept Refinement

Style Guides

Production Phase I

Production Phase II

Production Phase III

Complete Design

System

Product Impact & Outcomes

The corporate website was pivotal to Paybima’s omnichannel strategy, emphasizing both digital capabilities and in-person advisory expertise. The needs analysis process underwent significant optimization, reducing friction points while enhancing personalization through intelligent nudges and feature highlighting. The resulting platform represents a sophisticated blend of traditional insurance expertise and digital innovation. It creates an ecosystem that serves both educational and transactional needs while maintaining the human element essential to insurance advisory services, exemplifying digital insurance customer experience design.