The Challenge

Present in 14 languages, Airtel Payments bank reaches out to its diverse user base through customized product offerings. The bank envisaged to be recognized as a financial service provider beyond just telco transactions. In a competitive market for financial solutions, the challenge was to be the preferred payment option for transactions.

A major impediment in this was to build a highly intuitive platform enabling universal users to transact quickly and easily. A competitive edge needed to be implemented through providing customized offers, helping users compare and choose the right product, offer cross-selling and up-selling solutions and alike. Drawing from customer needs to build an intelligent system which could supplement making their financial transactions easy and beneficial, was the need of the hour.

Our Methodology

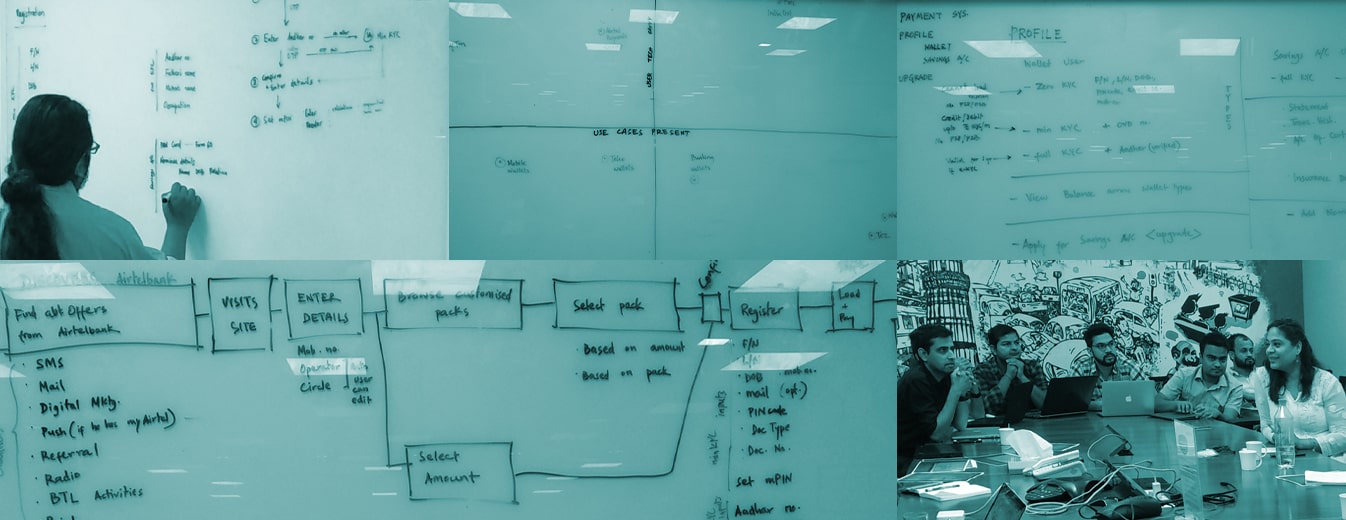

At Think Design we ensure to understand the comprehensive ecosystem and project brief before moving on to strategizing and solutioning. This encompasses understanding the basic intent of the product existence, probing on the business opportunities and understanding positioning & user needs. User needs have to be captured to understand the scope of work involved. User needs are basically what is that the end-user wants to do with the product or in an ideal scenario.

Persona Mapping was hence used initially into the project as a research methodology to capture the diverse perspectives of the prominent stakeholders of Airtel Payments Bank. Based on the insights gathered a need-based information model approach was proposed to cater to all the use cases and provide an intuitive experiential approach to the customers.

It is important to have captured the information in the right hierarchy which will define the overall structure /workflows of the application. Hence an information architecture followed by framework which defines the basic navigation of the application were put in place.

To indicate and give an idea of how the application will actually work, wireframing is done and the Surface GUI defined, being the actual eye candy for the user as one of the most important layers of the overall UX. Here the colors patterns, fonts, icons & padding were defined to give the best possible aesthetics by our team in consideration of the visual requirements of Airtel.

Key Insights

The insights discovered from our user research and workshops served as the founding principles to formulate the design directions. What was found common were pain points and challenges articulated across by people of different generations, ubiquitously.

1. Focus on one-stop financial solutions for customers

Users increasingly need digitized end to end solutions that provide value for money by being seamless, quick, convenient and secure. Ability to complete multiple similar tasks efficiently such as paying multiple/upcoming bills together is highly desirable from a financial platform.

2. Move towards self-assist mode by providing an extremely user-friendly design

Users look for a simplified and intuitive experience which is guided by non-confusing journeys and shorter form filling.

3. Customize for the intelligent consumer

Personalized offers based on user’s profile(number of activities user performs on the app), clear and prominent calls to action and efficient problem redressal could go a long way in creating a financial platform of choice.

Key features

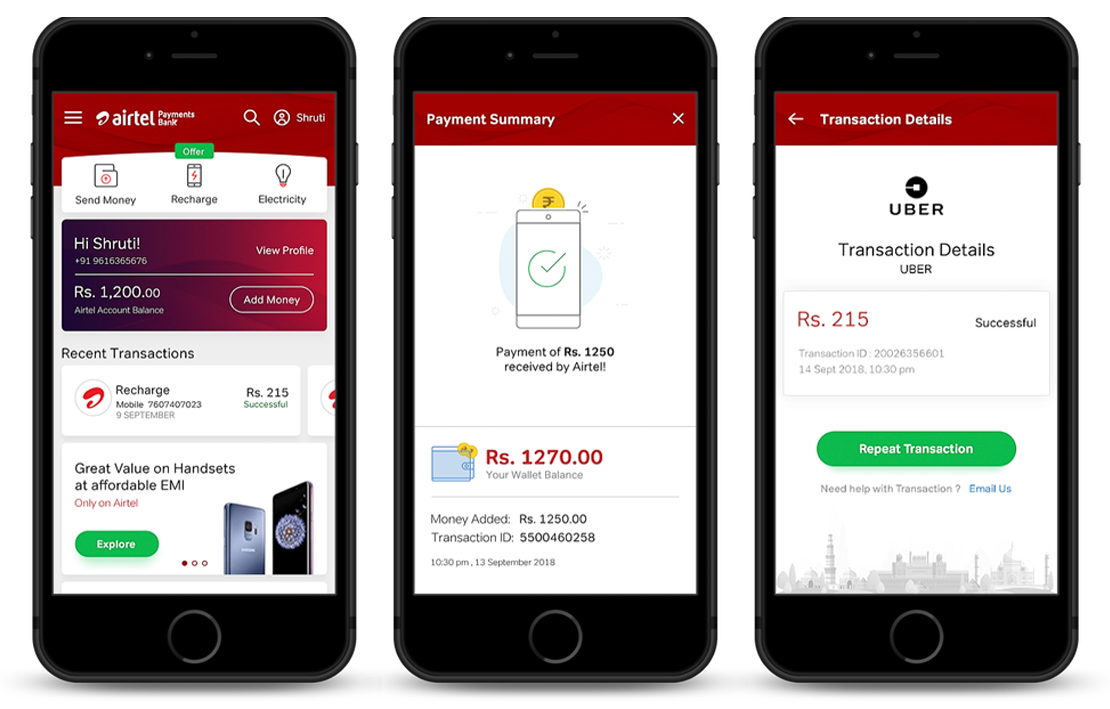

1. An interface contextualized to business and user goals:

The user interface was simplified and made intuitive keeping in focus the needs of the users and business, keeping the user journey easy throughout. The personality of the user being informal, honest, inspiring and warm guided the visual layout to make the portal feel reliable and personalized to customers.

2. One-Stop Recharge Destination

Fast track instant payments, provision to pay upcoming bills on both web and mobile were provided. A categorization of bill payments across services Prepaid/Postpaid recharge, Dth recharge, Data recharge, Electricity, Gas, Water, Insurance were created, with personalized offers listed both online and offline.

3. Registration made versatile

Users could now login through mpin, OTP increasing user flexibility, and also reset the pin options seamlessly. Profile registration and KYC forms were made easy and minimal to fill with (multiple options were made available to select in terms of identification proofs). A carefully designed navigation flow made the process convenient and quick for the customers.

4. Hassle-free transfers

Features like Web sending money, adding money, OTP cases, were made seamless through structured hierarchies. Typeahead search features could enable users to also repeat previous transfers with minimum new inputs.

DESIGN ACTIVITIES

Consulting, Stakeholder Workshop, Strategy and Product Definition, Visual System, UI UX Design, Front end Development and Integration.

CURRENT STATUS

Enhanced experience of India’s first payments bank, Airtel Payments Bank was launched in February 2019 by Bharti Airtel, India’s largest telecom provider to support the cashless revolution promised by the Government of India.