Our Strategy

The Thinker Approach

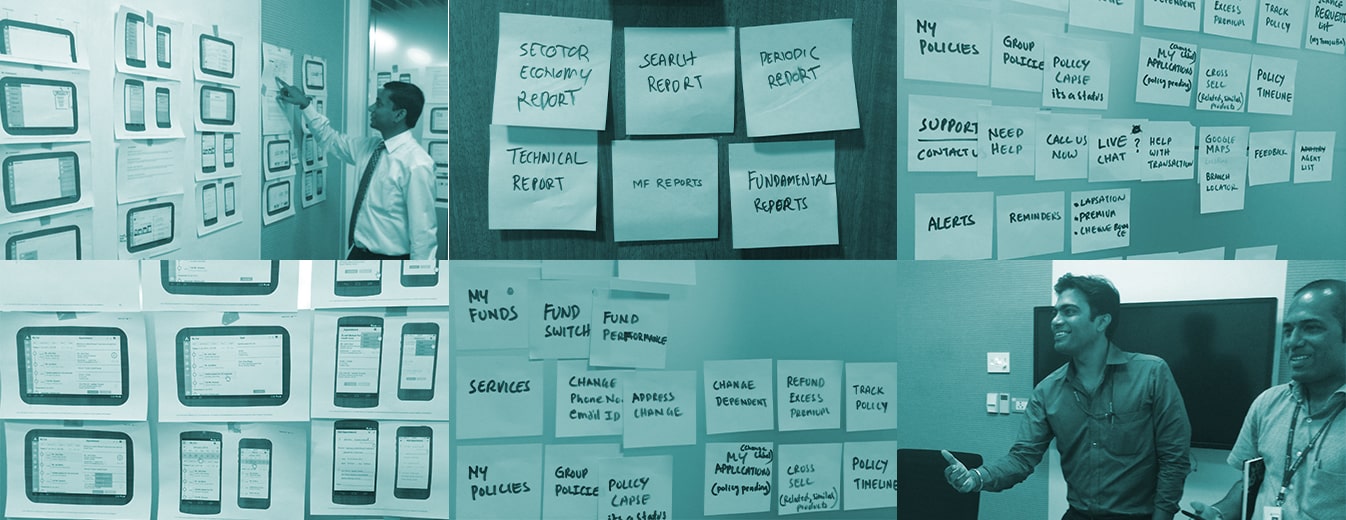

The challenge was to organize and plan well for a large and busy bank, keep on course all the time and advocate user-centred practices while delivering on vision, ultimately creating tangible, usable and valuable products in the hands of on-ground relationship managers.

We started by identifying the components of success and trickled down to tactical points that helped us architect specific areas of intervention. This approach led to conceptualizing an ecosystem of apps that got individualized focus, with products tied to each other through the Axis ecosystem yet independent in order to be deployed to teams with specific KPIs.

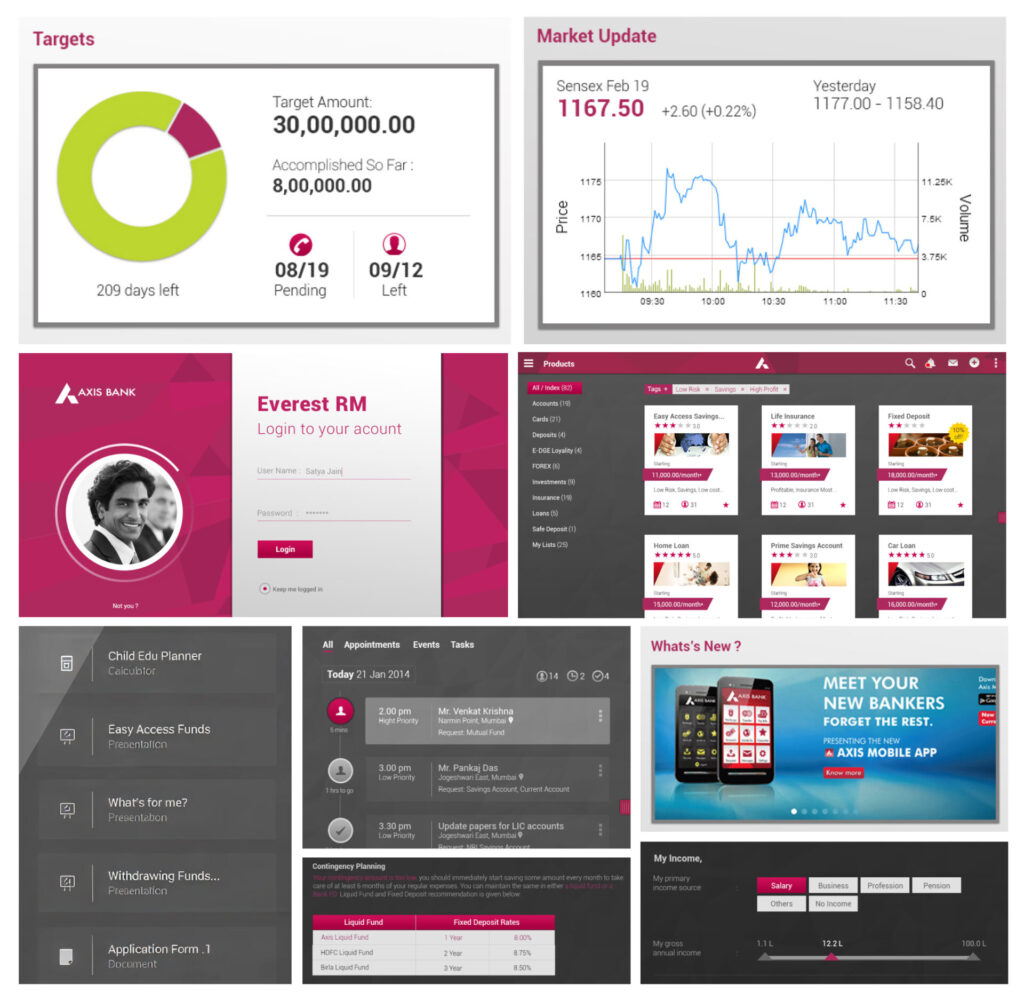

Three independent products were built and tied to each other: Relationship Manager app, Account opening app, and CMS system that housed product information and digitized brochures. This ecosystem approach ensured both cohesiveness and flexibility in deployment.

Insights We Drew/ Insights Inferred

Being a large bank and one of the busiest in the country required careful organization and planning to deliver on the vision while maintaining user-centred practices. The initiative needed to go beyond digitization to truly transform how relationship managers work, mapping and re-imagining workflows, interconnecting information and business processes.

Various themes, contrasts, elements and forms were explored along with brand guidelines to shape a balanced visual branding for the apps. The design system focused on laying out various elements of interaction and functionality, tying them through a common design theme thereby making way for consistent and scalable experience across the app ecosystem.

Key Strategic Interventions

Component-Based Success Identification

We identified components of success and trickled down to tactical points that helped architect specific areas of intervention, creating a structured approach to the transformation.

Ecosystem Architecture

An ecosystem of apps was conceptualized with individualized focus, tied together through Axis ecosystem yet independent for deployment to teams with specific KPIs.

Workflow Re-Imagination

Workflows were mapped and re-imagined interconnecting information, tools and business processes, moving beyond mere digitization to actual transformation.

User-Centered Advocacy

User-centred practices were maintained throughout the process while organizing and planning for one of the busiest banks in the country, ensuring delivery on vision without compromising user needs.

KEY FEATURES

01

Three Interconnected Apps

Ecosystem comprises Relationship Manager app, Account opening app, and CMS system housing product information and digitized brochures, tied together yet independently deployable.

02

Balanced Visual Branding

Various themes, contrasts, elements and forms explored along with brand guidelines to shape balanced visual branding that reflects Axis Bank's identity across all apps.

03

Consistent Design System

Design system lays out various elements of interaction and functionality, tied through common design theme for consistent and scalable experience across the ecosystem.

04

Efficiency-Driven Features

Apps designed to increase efficiency, reduce paperwork, bypass dependencies, and resolve user pain points for on-ground relationship managers.

05

Interconnected Information Architecture

Information, tools and business processes interconnected across the ecosystem, enabling seamless workflows for relationship managers.

06

KPI-Specific Deployment

Independent app structure allows deployment to teams with specific KPIs while maintaining ecosystem cohesiveness through Axis integration.

DESIGN ACTIVITIES

Insight and Strategy

Workshop

Product

Definition

Ideation

Documentation

Design Iteration

and Evaluation

Design System

Visual Branding

UI Guidelines and

Specifications

Dev. coordination

Product Impact & Outcomes

The apps were launched by Axis Bank in 2013 as part of their digital transformation initiative. The resulting ecosystem successfully empowered relationship managers across the country with next generation banking tools, creating tangible, usable and valuable products that transformed banking workflows from paper-based processes to efficient digital experiences, demonstrating how strategic design can enable large-scale banking transformation.