Our Strategy

The Thinker Approach

Understanding that digital lending journey design requires balancing speed with security while maintaining user trust, our team began by engaging with relevant stakeholders to identify critical user needs and priorities. We conducted comprehensive user research to create detailed personas that would guide the development of user journeys and task flows aligned with real customer behaviors and expectations.

Our competitive analysis of market players revealed critical insights about loan timelines, documentation requirements, and the strengths and weaknesses of existing lending portals. These collaborative discovery sessions, combined with our analysis of successful digital lending patterns, shaped our understanding of what drives user confidence in financial applications. This foundational research informed our design direction and helped establish UI benchmarks specifically tailored for SimplyCash’s target audience of creditworthy, digitally-native customers.

Insights We Drew/ Insights Inferred

Given that SimplyCash operates in the competitive personal lending space where trust, transparency, and speed are paramount, it was essential to create a platform that resonates with millennial users while maintaining the security and professionalism expected from financial services.

Our research for the android fintech app design revealed three critical insights that would shape the platform’s design philosophy. First, we recognized that an informal interface requiring minimal data entry would appeal to India’s most populated demographic while encouraging repeat usage. Second, we discovered that users prefer pictorial selection methods, brand-aligned typography, and consistent color schemes that reduce cognitive load during the application process. Finally, we understood that perceived security and transparency were not optional features but fundamental requirements for driving adoption and sustained usage among digitally-savvy customers who demand clarity about their financial commitments.

Key Strategic Interventions

Real-Time Digital Processing

We designed a seamless loan application journey that enables instant disbursement without human intervention or physical documentation, eliminating traditional lending friction points.

Lifecycle-Based Product Intelligence

The platform incorporates continuous customer insight harvesting to offer appropriate financial products at different stages of the user’s relationship with SimplyCash.

Transparent Financial Management

We created tools including loan calculators and comprehensive dashboards that provide visibility into loan status and EMI schedules, building user confidence through information accessibility.

Trust-Centric Interface Design

The design language prioritizes security perception and transparency, ensuring users feel confident about their financial data and lending commitments throughout the journey.

KEY FEATURES

01

Instant Loan Disbursement Engine

A fully automated processing system that evaluates creditworthiness and disburses loans in real-time without requiring physical documentation or manual intervention. The system streamlines the traditionally complex lending process into a frictionless digital experience.

02

Intuitive Loan Calculator

An interactive tool that empowers users to understand their borrowing capacity and repayment obligations before committing to a loan. The EMI calculator UX pattern provides transparency and helps users make informed financial decisions aligned with their personal finance goals.

03

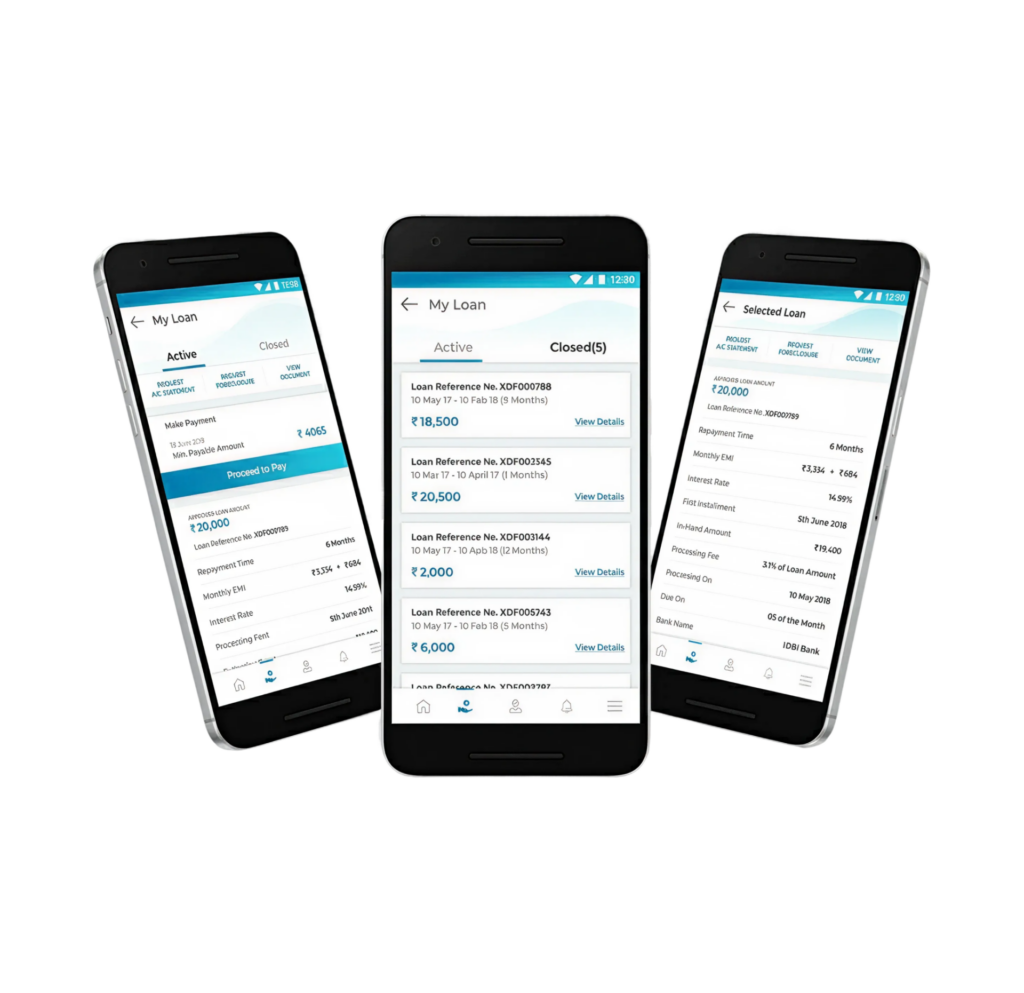

Unified Loan Dashboard

A comprehensive command centre where users can view their complete loan status, track disbursement progress, monitor EMI schedules, and manage their lending relationship with Hero FinCorp from a single interface. The dashboard incorporates invoice management dashboard UX principles to present complex financial information in an accessible, scannable format.

04

Millennial-Optimized Interface

A clean, informal design system featuring pictorial selection methods, brand-aligned typography, and consistent color schemes that reduce data entry requirements while maintaining professional credibility. The interface speaks the language of digital-native users while preserving financial service standards.

05

Smart Product Recommendations

An intelligent system that analyzes user behavior and financial patterns to suggest relevant lending products throughout the customer lifecycle, creating opportunities for ongoing engagement beyond the initial loan application.

06

Paperless Verification System

A digital-first verification process that eliminates the need for physical proofs while maintaining robust security standards, enabling the platform to serve users efficiently while minimizing operational costs.

DESIGN ACTIVITIES

Consulting

Stakeholder

Workshop

User Interviews

Wireframing

Visual System

Front End

Development

Dev.

Coordination

Product Impact & Outcomes

The SimplyCash Digital Lending Platform UX successfully democratizes personal lending by creating a fully digital solution that removes traditional barriers to financial access. Launched in mid-2018, the platform’s strategic positioning as a transparent, instant, and trustworthy lending solution differentiates Hero FinCorp in the competitive NBFC landscape while providing tangible value to creditworthy digital customers.