The financial services industry has entered a decisive moment. In 2025, financial institutions aren’t just competing on interest rates, product features, or accessibility. They are competing on building experiences that move the industry. And in finance, experience must coexist with compliance.

For industry leaders and other players in the fintech and banking market, compliance isn’t a choice. Regulations demand that products protect users, ensure transparency, and maintain operational integrity throughout all financial services availed. At the same time, customers expect digital experiences that are seamless, intuitive, and even delightful. The organizations that bridge this delicate balance are the only ones that would thrive in this cutthroat market. The challenge, then, is clear: How do you design financial products that meet stringent regulatory requirements without creating friction that drives users away?

Stuti Mazumdar - November 2025

“When experience becomes the key differentiator, every interaction becomes a chance to build or lose trust.”

— Deekshit Sebastian, Design Studio Head at Havas Think Design

Why Should Compliance Be a Big Part of Fintech User Experience?

Fintech companies, while building their products or services, have traditionally leaned toward what we call “module-first thinking.” Platforms were built to satisfy internal checklists for people working behind the product. For instance, loans in a section, transfers hidden under a different part of the app, and credit and debit cards visible to anyone using the app as long as you’re logged in. Compliance checks were bolted on as separate steps, often making user journeys complex, longer, and more frustrating.

But customers don’t think in modules. They think in end results that we classify as user goals, such as “pay my contractor”, “wire money to family”, or “save for education”. When compliance creates friction instead of trust, users abandon the experience altogether. The future of fintech requires rethinking this gap. And here, compliance isn’t an afterthought; it must be embedded into user flows as a design principle. If and when done well, regulatory compliance should be made invisible (but transparent) yet reliable to remind users that their data and money are secure, without making them feel constrained.

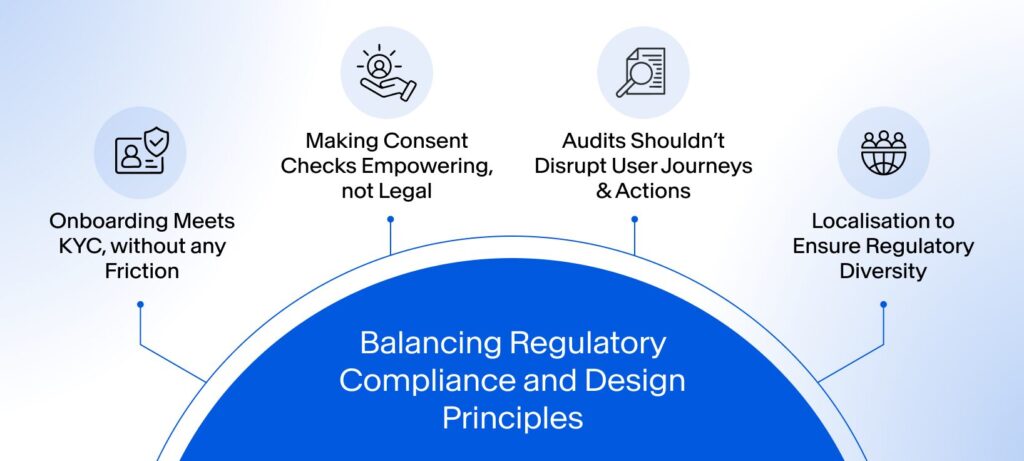

Balancing Regulatory Compliance and Design Principles

Balancing compliance with user experience requires UX professionals to look at customer experience strategy and regulatory systems altogether. Here are the pillars shaping this balance today:

1. Onboarding Meets KYC, Without Any Friction

Know Your Customer (KYC) checks are essential in fintech institutions. But if identity verification itself is too complex for a user at signup, they might drop off before completing the process, thereby never enjoying the stellar experience you may have created for later.

As designers, we must use progressive disclosure. Ask for the minimum required information upfront, while providing clear feedback on why the required documents are needed by the product. A well-designed KYC flow will thus transform compliance from a barrier into a trust-building moment.

2. Making Consent Checks Empowering, Not Legal

Financial services require multiple and constant consent checks, including data sharing, risk disclosures, loan terms, and more. Too often, these appear as endless fine print, hidden away as T&C that users just need to check off before proceeding.

Simplify your consent forms or conditions into clear, human-centered microcopy, layered with “learn more” options, allowing users to explore the legal information in-depth if needed. In doing so, your users would feel in control of their decisions, while regulators see evidence of informed consent.

3. Audits Shouldn’t Disrupt User Journeys & Actions

Every action in a fintech product, including a loan application, a fund transfer, or simple balance checks, needs auditability. When poorly integrated, these checks add unnecessary steps that may lead to friction in the user’s current action.

It is ideal to automate background compliance checks while keeping users focused on their tasks at hand. Notify them only when an action is required on their end.

4. Localization To Ensure Regulatory Diversity

Financial regulations vary not just globally, but within countries like India, where languages and cultures drastically change within a few miles. A lending app that works in New Delhi may require tweaks for a Tier-3 city like Patna, both legally and behaviorally.

To start, build a flexible design systems that adapt language, workflows, and disclosures to regional regulatory compliance. Meeting users where they are through language and design in your product would only build trust and loyalty in your brand. Additionally, this allows fintech institutions to scale across diverse markets without sacrificing either compliance or customer resonance.

Designing for Scale and Compliance at Think Design

At Think Design, we’ve seen firsthand how embedding compliance into design transforms experiences for our global partners.

For Spandana Sphoorty Financial Limited (SSFL), a non-banking finance company serving low-income households, we redesigned their loan origination and management systems alongside a self-service customer portal. Compliance requirements were non-negotiable, but so was usability for loan officers, branch managers, and rural customers. Our solution was simple. User research-led flows that simplified compliance-heavy processes, ensuring transparency without overwhelming users.

In our work with PayBima by Mahindra Insurance Brokers, we crafted an omnichannel experience that brought the power of intelligent digital design to the legacy of in-person trust. From digital quote journeys to real-time tracking, from smart advisor dashboards to BimaBuddy, our approach merged human and digital into one seamless flow.

These examples highlight that compliance isn’t a blocker to good UX—it’s an opportunity to build trust, loyalty, and efficiency.

How is Compliance Built in Fintech Systems in the Age of AI?

With the rise of AI and predictive systems in finance, customers expect smart recommendations at every part of their journey, but regulators require transparency on how those recommendations are generated.

The design challenge here is creating interfaces that explain AI decisions and suggestions in simple language without overwhelming users while they make taxing financial decisions of their own. For example:

“This investment recommendation is based on your age bracket.”

“This investment recommendation is based on your expense pattern in the last month.”

Such disclosures not only satisfy regulators but also enhance user trust in AI-driven services.

How Can We Design With Ever-Changing Regulatory Compliance?

Financial regulations are never static. From RBI circulars in India to GDPR updates in Europe, requirements shift rapidly with the ever-evolving socio-political and financial changes. For digital products, this means building for adaptability and scale.

For instance, if you were to design for a leading affordable housing finance institution (personal or home loans), flexibility should be your north star. Housing regulations change frequently, so you must create modular workflows that can be updated without overhauling the entire system. This approach safeguards compliance while keeping user journeys consistent.

A Human-Centered, Compliant Future

The financial institutions that will lead the industry moving forward are those that treat compliance as part of their customer experience (CX) strategy. This requires embedding regulatory requirements into the design frameworks and processes, aligning design and compliance teams early on, and creating adaptive, human-centered systems.