Experience-Driven Practices Redefining the Industry's Future

82% of banks, insurers, investment managers plan to increase FinTech partnerships; 88% concerned they’ll lose revenue to innovators*.

Key trends that are changing the BFSI industry

1. Traditional institutions not in pace with Digital and emerging FinTechs

2. Inability to leverage Customer Intelligence as a precursor of growth

What could be some major impediments to the above:

- Existence of a transactional relationship with banks, which has created a gap between the needs of the customer and the services banks offer.

- Most financial applications and services(such as transactions)are unexciting and cumbersome to use complex to understand and engage with.

- Financial institutions not seen as catalyzing financial well being as they are not able to dispense financial advice, strategies, and support effectively and in a robust manner.

- Delay of traditional players to shift to digital and adopt technological and design innovations on the fly.

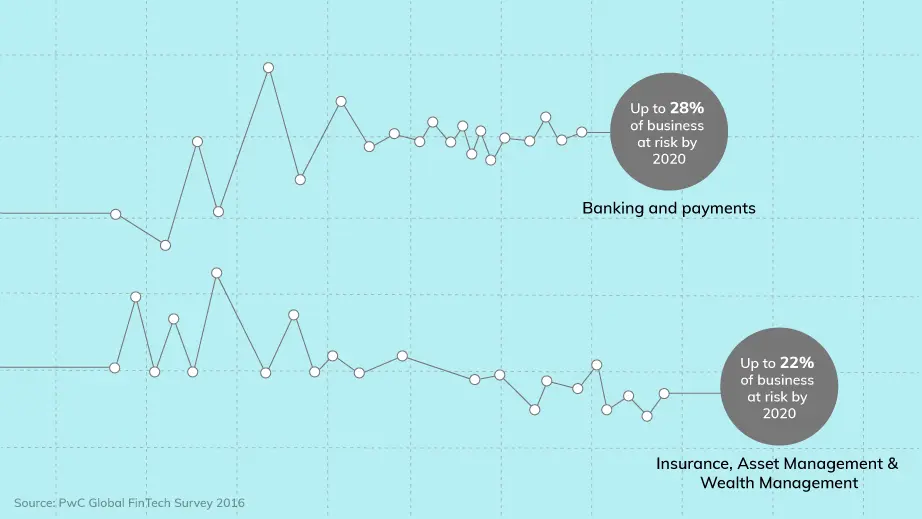

Estimated percentage of business revenues that will be at risk by 2020 due to disruption in banking is 28% and 22% in insurance, asset and wealth management*.

Technological solutions are definitely important to reckon with to ease off the risk while re-engineering the face of the sector, yet technology without design is as obsolete in value, as ideas are without language.

Designing superior fintech solutions

Design Thinking and UX can bring indispensable value on the table by:

1. Understanding Needs through thorough research:

2. Making it Simple

3. Bracing for the future

4. Reducing complexity, latency and ensuring safety

Design hence becomes incumbent in today’s world as it takes a consumer-centered approach that puts the discovery of highly nuanced, even tacit, consumer needs at the forefront of the innovation.

Detailed Impact and future trends in the Financial Services sector:

of incumbents expect to increase FinTech partnerships in the next 3-5 years

expect to adopt blockchain aspart of an in production system or process by 2020

expected annual ROI on FinTech related projects

1

Insurance

Homogenization of Risks

Self Insuring gains momentum (reducing overall revenue for the industry)

Growth of personalized and customized insurance

Think Design’s Recommendation

2

Payments

Towards a cashless economy

Integrated and seamless payments

Emerging alternate payment rails

Think Design’s Recommendation

3

Deposits & Lending

Customer-centric banking

Emerging alternative lending models

Think Design’s Recommendation

4

Investment Management

Automated investment management platforms

Process Externalization of services

Think Design’s Recommendation

5

Market Provisioning

New information platforms

Growth of algorithmic trading

Think Design’s Recommendation

Think Design’s approach and recommendations to achieve superior banking customer experiences

1. Segment right

2. Design for journeys

3. Detail interactions

4. Focus on affordances

5. Always test

Impactful partnerships across Banking, Financial Services, Insurance and Fintech

Creating Value in Every Industry

News media & Entertainment

Know More

Enterprise & IT

ERP, Utilities, HRMS, Planning tools, Data & Analytics, LMS, Enterprise systems, Productivity suites.

Know More

Healthcare & Lifesciences

Medical devices, Hospital management systems, Pharma, Wearable tech, Personal healthcare, Fitness, Wellness.

Know More

Networks & Smart devices

Telecom, Home automation, Data networks, M2M, IoT, Utilities, Law enforcement, Defense & Border security.

Know More

Education & Edtech

Institutions, Portals, Apps, Learning management, Gamified learning, MOOCs, Universities, Learning centers.

Know More

Banking & Financial Services

Fintechs, Banks, Insurance, Payments, Wallets, Lending, Trading, Investment, Blockchain, Currencies, Wealth management.

Know More

End-to-End Design Expertise